You can also view this newsletter as a PDF.

Controller Yee Highlights Changes in

Place for 2021 Tax Filing Season

Tax filing season is here. The California Franchise Tax Board (FTB) and the federal Internal Revenue Service (IRS) are now accepting and processing returns for 2020 income. The IRS has made programming updates following December 2020 tax law changes that provided a second round of economic impact payments. Under these changes, eligible individuals will receive any stimulus funds not yet received as a Recovery Rebate Credit when they file a federal tax return on their 2020 income.

For faster refunds and increased accuracy, taxpayers are urged to file electronically and provide their direct deposit information. The deadline to file and pay any tax owed is Thursday, April 15, 2021. For this filing season, FTB expects to process 20 million personal income tax (PIT) returns; the IRS expects more than 150 million PIT returns.

Earned Income Tax Credit and Young Child Tax Credit

The federal Earned Income Tax Credit (EITC) and the California Earned Income Tax Credit (CalEITC) help low- to moderate-income workers and families receive a tax break. The credit is refundable, meaning it not only reduces taxes owed but will be refunded to a filer who does not have a tax liability. This year, eligibility for CalEITC was expanded to taxpayers with an Individual Taxpayer Identification Number.

For tax year 2020, unemployment payments and other unearned income received could affect the amount of earned income a worker can claim. However, under the federal Taxpayer Certainty and Disaster Tax Relief Act of 2020, people may elect to use their 2019 earned income to calculate the federal EITC if their 2019 earned income is more than their 2020 earned income but still within EITC eligibility limits, thereby maximizing their credit.

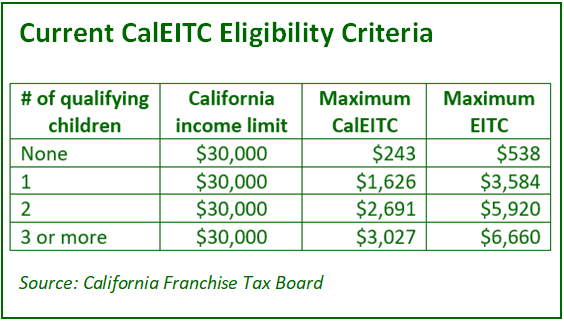

People who earned less than $30,000 in 2020 may qualify for CalEITC. Those who qualify for CalEITC and have a child under age six also may be eligible to claim the Young Child Tax Credit (YCTC), which is worth up to $1,000. Those earning less than $56,844 also may qualify for the federal EITC. Taxpayers may estimate their credit by using FTB’s credit calculator.

People who earned less than $30,000 in 2020 may qualify for CalEITC. Those who qualify for CalEITC and have a child under age six also may be eligible to claim the Young Child Tax Credit (YCTC), which is worth up to $1,000. Those earning less than $56,844 also may qualify for the federal EITC. Taxpayers may estimate their credit by using FTB’s credit calculator.

Golden State Stimulus

Governor Gavin Newsom’s proposed FY 2021-22 budget calls for a one-time $600 payment to individuals who claimed the CalEITC based on their 2020 tax filing. On February 17, the Legislature reached agreement on the proposal, providing another way to help low-income Californians who have faced income losses during the COVID-19 pandemic.

CalFile and Volunteer Income Tax Assistance

FTB offers free electronic filing for many state tax returns through CalFile, an easy-to-use tool available to more than 6.5 million taxpayers. CalFile allows taxpayers to e-file directly with FTB and provides instant confirmation when the return is received. CalFile is available for those claiming the CalEITC and YCTC, those who are claiming the standard or itemized deduction, and those with income as high as $400,000.

Income-eligible Californians who need help filing a PIT return can also find help through Volunteer Income Tax Assistance (VITA) program locations throughout California. Due to public health considerations during COVID-19, a number of VITA locations will operate virtually, while others will be held in person with an appointment. In addition, taxpayers can file a federal tax return online using the IRS Free File program.

FTB Customer Service

FTB communication channels provide services and information to help taxpayers file accurate and timely tax returns and pay the proper amount owed. FTB communication channels include a customer service line at (800) 852-5711, a tax practitioner hotline, authenticated chats, and assistance at field offices. During the last tax season, FTB communication channels were accessed more than 2.1 million times.

FTB offers many online tools including MyFTB and the Where’s My Refund tool. The MyFTB service allows taxpayers to view their tax documents, check balances due, access tax calculators, and send secure messages to FTB staff. It normally takes up to two weeks to receive a refund for e-file return and up to four weeks for a paper return. The Where’s My Refund tool allows taxpayers to check the status of a refund.

Main Street Small Business Tax Credit

For the 2020 tax year, a Main Street Small Business Tax Credit was available to qualified small businesses. The credit sought to provide financial relief to those small businesses that experienced economic disruption in 2020, resulting in unprecedented job losses. The credit only applied to California small businesses that met the following qualifications:

- Employed 100 or fewer employees as of December 31, 2019; and

- Suffered a 50-percent or higher decrease in income tax gross receipts when comparing the second quarter of 2020 to the second quarter of 2019.

Taxpayers had the option of using the credit against income taxes or making an irrevocable election to apply the credit against sales and use taxes. The California Department of Tax and Fee Administration (CDTFA) is responsible for allocating the credit on a first-come, first-served basis, and the reservation process is now closed. Seventy percent of the credit was allocated for income taxes, and the balance was for sales and use taxes. The credit was capped at $100 million; the governor’s FY 2021-22 budget proposes an additional $100 million for this program.

Net Operating Loss Suspension

For tax years 2020 through 2022, California has suspended the net operating loss (NOL) carryover deduction. However, taxpayers with net business income, modified adjusted gross income (PIT taxpayers), or taxable income (corporate taxpayers) of less than $1 million – or with disaster loss carryovers – are not affected by the NOL suspension.

Taxpayers may continue to compute and carry over a NOL during the suspension period. The carryover period for suspended losses is extended by:

- Three years for losses incurred in taxable years beginning before January 1, 2020;

- Two years for losses incurred in 2020; and

- One year for losses incurred in 2021.

Credit Limitation

For tax years 2020 through 2022, there is a limitation on the application of all credits. For PIT filers, the total of all business credits including the carryover of any business credit for the taxable year may not reduce the “net tax” by more than $5 million.

For corporate taxpayers, the total of all credits including the carryover of any credit for the taxable year may not reduce the “tax” by more than $5 million.

For taxpayers included in a combined report, the limitation is applied at the group level. Credits disallowed due to the limitation may be carried over. The carryover period for disallowed credits is extended by the number of taxable years the credit was not allowed. The limitation does not apply to the Low-Income Housing Tax Credit.

Commercial Cannabis

Beginning in tax year 2020, California allows individuals and other PIT filers to claim credits and deductions for business expenses paid or incurred during the taxable year in conducting commercial cannabis activity. Prior to this change, PIT law conformed to federal law, which did not allow deductions or credits for commercial cannabis activity. Under corporate tax law, a licensee engaged in commercial cannabis activity is allowed otherwise allowable deductions or credits, assuming the entity has adequate records to substantiate these items.

COVID-19 Economic Impact Payments

COVID-19 Economic Impact Payments

Stimulus payments individuals received from the federal government in 2020 under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, as well as payments received under the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 (CRRSA), are not subject to California income tax.

Unemployment Compensation

Unemployment compensation, including the emergency $600 per week increase in unemployment compensation benefits individuals legally received under the CARES Act and the $300 per week increase individuals legally received under the CRRSA, are not subject to California income tax.

Paycheck Protection Program Loan Forgiveness

For taxable years beginning on or after January 1, 2020, California provides an exclusion from gross income for covered loan amounts forgiven under the CARES Act, Paycheck Protection Program (PPP) and Health Care Enhancement Act, or the Paycheck Protection Program Flexibility Act of 2020.

The Consolidated Appropriations Act signed in December 2020 allows deductions for eligible expenses paid for with covered loan amounts that would be, or would reasonably be expected to be, forgiven under the PPP. As of February 17, California is considering partial conformity by allowing companies to deduct up to $150,000 in expenses covered by the PPP loan.

Gig Economy and Worker Classification

The gig economy, which also is called the sharing economy or access economy, involves activity where people earn income providing on-demand work, services, or goods. Often, it is through a digital platform like an app or website. The income from this activity is taxable and must be reported on a tax return, even if the income is:

- From part-time, temporary or side work;

- Not reported on an information return form such as a form 1099-K, 1099-MISC, W-2, or other income statement; or

- Paid in any form, including cash, property, goods, or virtual currency.

Due to recent changes to California law, the California Labor and Workforce Agency has developed some frequently asked questions to help the public understand current worker classification guidelines.

Health Care Coverage Penalties for Tax Returns in 2021

Last year, a new state law required Californians to have qualifying health insurance coverage throughout the year. Those who do not maintain qualifying medical coverage are subject to a penalty of $750 or more when they file their tax returns. The penalty for a dependent child is half of what it would be for an adult. A married couple without coverage could see a penalty of $1,500 or more. For a family of four with two dependent children, it could be $2,250 or more. Health coverage and financial help is available through Covered California.

Renewed Federal Support for Paris Climate Agreement

Expected to Accelerate Net-Zero Transition

On his first day in office, President Joe Biden signed an executive order to bring the U.S. back into the Paris Climate Agreement, demonstrating the importance the new administration places on climate change. His appointment of top-level climate advisors throughout government – including his economic council, State Department, and cabinet – will ensure all parts of the federal government are focused on the work ahead to mitigate the impacts of climate change.

On his first day in office, President Joe Biden signed an executive order to bring the U.S. back into the Paris Climate Agreement, demonstrating the importance the new administration places on climate change. His appointment of top-level climate advisors throughout government – including his economic council, State Department, and cabinet – will ensure all parts of the federal government are focused on the work ahead to mitigate the impacts of climate change.

The U.S. is the second-largest carbon emitter in the world, so the decision to formally reenter the global agreement to reduce emissions is crucial to limiting global warming to well below 2 degrees Celsius, and ideally to no more than 1.5 degrees above pre-industrial levels. Although the White House plans to announce by mid-April specific carbon emission reduction targets to meet the Paris goals, the World Resources Institute estimates emissions will need to be cut in half from 2005 levels.

The executive order also initiated a major review of the prior administration’s rollback of environmental and public health protections including weakening of endangered species protections, forest management, oil and gas emissions standards, and pollution control standards. The reestablishment of an interim social cost of carbon will ensure federal agencies account for the full costs of greenhouse gas emissions – including climate risk and environmental justice. The move could be a precursor to adopting a national carbon price, which would help investors determine the long-term risk of carbon emissions to their portfolios.

The full commitment of the Biden administration is expected to speed the pace of change in a number of areas. Federal procurement can be used to signal the market through the purchase of electric vehicles and other clean energy products. Updated regulations should accelerate the transition to clean power producers relying on solar and wind. The administration also has pledged to prioritize investments in American research, development, and innovation that pave way for new clean energy technologies.

Another crucial piece of the climate puzzle, particularly in light of job losses and increased economic insecurity suffered by many vulnerable communities due to COVID-19, is to ensure those underserved communities reap the benefits of clean-energy jobs, reduced pollution, and heightened resiliency. President Biden’s “Buy American” executive order requires the federal government to purchase supplies and products from American companies, which will create more jobs and increase demand for clean energy.

The COVID-19 pandemic has shown we cannot return to business as usual. Last summer, Controller Yee joined with stakeholders from environmental justice communities, mainstream environmental organizations, and forward-thinking business groups to develop core equity principles to ensure America builds back better. California already has ambitious climate and energy goals, including reducing GHG emissions to 40 percent below 1990 levels by 2030. The state has set a target of 100 percent carbon-free electricity by 2045 and the sale of only zero-emission vehicles by 2035. These investments can support green spaces, water systems, electric grids, clean transportation, and tangible climate benefits, all of which can help lessen the devastating impacts of sea-level rise, drought, flood, and wildfire.

The COVID-19 pandemic has shown we cannot return to business as usual. Last summer, Controller Yee joined with stakeholders from environmental justice communities, mainstream environmental organizations, and forward-thinking business groups to develop core equity principles to ensure America builds back better. California already has ambitious climate and energy goals, including reducing GHG emissions to 40 percent below 1990 levels by 2030. The state has set a target of 100 percent carbon-free electricity by 2045 and the sale of only zero-emission vehicles by 2035. These investments can support green spaces, water systems, electric grids, clean transportation, and tangible climate benefits, all of which can help lessen the devastating impacts of sea-level rise, drought, flood, and wildfire.

Government cannot make the transition alone. Corporations and investors will need to continue the work that has started. For example, after then-President Donald Trump withdrew from the Paris Agreement four years ago, the global nonprofit Ceres, of which Controller Yee is a board member, co-launched the We Are Still In coalition. Over 2,100 U.S. corporations and investors pledged to continue analyzing, refining, and changing their operations and supply chains to reduce carbon emissions.

Urged on by investor coalitions and advocacy groups, corporations are beginning to coalesce around a standard sustainability disclosure framework that helps investors evaluate how a company is responding to, and planning for, the risks inherent in climate change. Over the past five years, more than 1,050 global and 180 U.S.-headquartered companies have set, or started the process of setting, science-based emissions targets in line with meeting the goals of the Paris Climate Agreement. Additionally, 264 large corporations, 74 percent of which have a major U.S. presence, have committed to 100 percent renewable energy over the next 20 to 30 years.

Institutional investors like CalPERS and CalSTRS have helped to lead the way on these investor coalitions, ensuring the weight of their capital is used to support a transition to clean energy. President Biden’s actions are providing investors greater assurance that investments in accelerating the net-zero transition will help to both de-risk their portfolios and generate attractive returns. Recent actions by the Federal Reserve Board and the U.S. Securities and Exchange Commission recognizing climate change as a financial risk also will help investors in their engagements with corporations and their analysis of their own portfolios.

Institutional investors like CalPERS and CalSTRS have helped to lead the way on these investor coalitions, ensuring the weight of their capital is used to support a transition to clean energy. President Biden’s actions are providing investors greater assurance that investments in accelerating the net-zero transition will help to both de-risk their portfolios and generate attractive returns. Recent actions by the Federal Reserve Board and the U.S. Securities and Exchange Commission recognizing climate change as a financial risk also will help investors in their engagements with corporations and their analysis of their own portfolios.

With a full partner on climate in the White House, Controller Yee looks forward to building America back in a cleaner, economically sound way that benefits all residents equitably, uplifts the most vulnerable, and establishes good-paying union jobs than can ensure middle-class livelihoods.